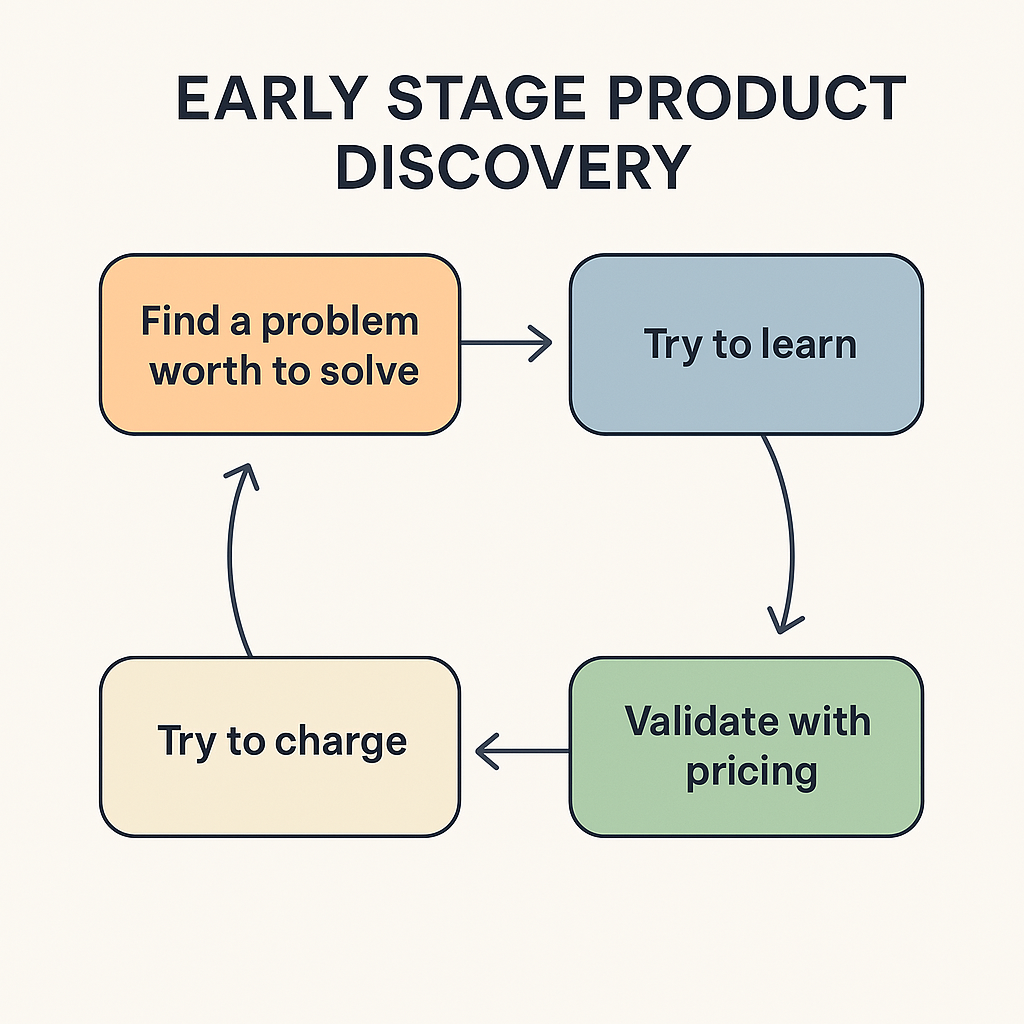

Each company offers at least one product/service that provides added value for other market participants. Early-stage start-ups often only have one product that can be offered, as resources are extremely limited, and the current market may not yet be fully understood. The fact that the founding team’s resources are largely allocated to one product means that the product is the cornerstone of the company’s future success. For this reason, it is very important that product discovery is carried out carefully by the founding team. In this article, I would like to share our experiences of how we as a founding team developed a B2B market and were able to place our first products. The focus on the B2B sector is important, as not all points can probably be transferred to the B2C sector. For example, we had very good experiences with conducting interviews with key stakeholders in contact with companies, whereas other B2C companies which participated in the same incubator and accelerator programs had good success with flashy marketing campaigns to validate their ideas.

Having outlined the significance of early-stage product discovery and its critical role in a startup’s journey, let’s now turn our attention to a more detailed definition of ‘Product Discovery’ and explore its scope in depth.

Product Discovery

ASince product discovery is a term that is understood in many different ways, it is important to have a clear definition and to know the scope. Geeks for Geeks defines product discovery as follows:

“Product discovery is a crucial stage in the process of creating successful products. It involves carefully exploring market needs, understanding what users want, and considering potential solutions before moving forward with development. By conducting thorough research and validation, product teams can reduce risks and increase the likelihood of delivering a valuable product.”

It is clear from the definition that product discovery is the core task at the beginning of a start-up. If it is not clear at the beginning which market is to be addressed and which problems and players exist there, then the founding team cannot create a satisfactory company vision from which individual steps and solutions can be derived. Here I assume that the founding team develops a vision together during the founding phase. This is probably the case in most situations, since alignment between the founders must be established with regard to which markets they should enter, which problems they should address and, above all, what the company should look like. It makes a big difference if, for example, one of the founders would like to set up a local non-profit organization, whereas others in the founding team would rather work on the next unicorn. With regard to external stakeholders, this very practically means that investors will have no interest in discussions and, more importantly, potential customers will not understand the added value of working with a startup. In the founding team, this will lead to a lack of focus and ultimately a loss of confidence in the start-up project. For this reason, it is extremely important for young founding teams to prioritize the topic of product. Unfortunately, I have seen that in the beginning, the more business-oriented people in the team created Excel spreadsheets with financial plans, while the tech-oriented people got lost in which technology should be used and directly coded or experimented with the hardware that should be used. This approach is problematic because the initial focus should be on finding a suitable problem for the founding team in a market that is appropriate for the desired corporate form.

With a clear understanding of what product discovery entails, it becomes essential to focus on identifying a problem that truly matters. Let’s now discuss how pinpointing a significant, market-worthy problem lays the foundation for your startup’s success.

Find a problem worth to solve

The most important thing is that founding teams find a problem in the ideation phase of the start-up that is worth solving. Marc Andreesen has very aptly described that the number one killer of companies is lack of market:

“

- When a great team meets a lousy market, market wins

- When a lousy team meets a great market, market wins.

- When a great team meets a great market, something special happens.

”

Therefore, when evaluating the problems, care should be taken to identify a market that is big enough or can become big enough for a startup to offer new solutions and grow with them. This is essential if products are to be developed where effects such as unit cost degression are to come into play. However, market size is also important for product discovery, as there is a high probability that customers will be burned in the first step. This should be taken into account especially by first time founders and founders who do not have many years of experience in the market in which a new solution is to be offered. For these two groups of founders, there is a high probability that the initial MVPs will disappoint customers. If the market is very small, this can quickly mean that your own brand is burnt out and no more customers can be acquired. Even if a company does well at first, it will probably have to change direction at some point. This is an especially difficult step for the team that started the company. They have worked hard to build a successful company that makes a profit in a small market. These companies are likely to face the innovator’s dilemma because they might not have the courage to take risks and try new markets.

The second step is to identify a problem that is annoying for the target group in the market and is difficult to solve on your own. This is important, as it may well be that problems are not perceived as such. Examples of this are tasks that are easy to automate but which the people working on them identify strongly with in the company and therefore do not want to hand them over. A fitting example for this step is the management of contract templates within legal departments. In many organizations, contract processes are still handled manually. Although there is significant potential for automation—such as in the compilation, updating, and versioning of contracts—the legal professionals involved are often deeply attached to these manual processes. They value the personal craftsmanship and individual oversight that these traditional workflows provide.

The challenge lies in the fact that while automation can reduce errors and save time, it can also be met with resistance because it interferes with a long-established process that many feel is indispensable. An innovative solution might be to implement software that automates routine tasks—like merging contract data or managing version control—while still preserving the ability for legal experts to apply their personal judgment and fine-tuning where it really counts.

This example underscores the importance of not only recognizing the technical feasibility of automation but also understanding the emotional and cultural ties that users have with their current processes. In early-stage product development, founders must pinpoint problems that are both significant and challenging to resolve independently. Only by addressing these deeper identification issues can a solution gain true traction in the market.

Having recognized the importance of finding a problem that is both significant and solvable, the next step is to immerse yourself in the market to gather real-world insights. In the following section, we will delve into how customer interviews and field studies can reveal the intricacies of your target market and its challenges.

Try to learn

Almost every blog post about product discovery emphasizes the importance of falling in love with the problem rather than the solution. That’s why I don’t want to dwell on this point here, but rather use the paragraph to explain what helped us fall in love with the problem and find out more about the domain and the problem.

By far the most important technique was conducting interviews and field studies with future customers, interest groups, companies offering similar solutions, and so on. Besides being the most important technique, it was also the one that was most consistent throughout the company’s history.

As founders, we were lucky to have started during the first lockdowns of the covid pandemic. This significantly increased the willingness of many stakeholders to talk to us via teams and to provide digital insights into their day-to-day business. We continued this with the first team members. Currently, product managers and designers in particular conduct interviews with customers and prospects to gain insights into their problems and explore their working methods. However, we have found that people are not always willing to take part in interviews regularly and do not always see the added value. At a later stage, it helped a lot when the sales team or customer success team involved product managers, designers and engineers in discussions and had the opportunity to ask questions and observe customers. In the early pre-MVP stage, when we were mainly active as founders, it helped to clearly communicate the product vision. We also had the unique opportunity as a founding team to move into an office at one of our first customers during the MVP creation phase. This helped us tremendously to have direct contact with the future users of our product and to be able to experience their working methods, communication channels, culture, etc. first hand. I would strongly advise every founder to request exactly this from selected companies. Often, these companies also have a very strong interest in this, since they are looking for a solution to an existing problem. We still follow this approach today and try to meet with potential customers at their offices to see how exactly they carry out the work that is associated with the problem.

Another good source of information and to learn more about an industry are trade associations. These are often involved in analyzing the problems of their members and frequently publish industry reports. For us, this was particularly valuable during the start-up phase as founders, enabling us to quickly learn a lot about our potential customers. In the later stages, we and our team mainly used the associations for networking. We also held webinars with them to raise awareness of current issues and our solutions.

While in-depth learning through interviews and direct observation is vital to understand your customers’ pain points, it’s also crucial to validate these insights financially. The next phase involves ‘charging’—testing the market by applying a price tag to your proposed solution to gauge its real-world value.

Try to charge

We’ve tried out different methods to help us find out what our customers want. This has included talking about designs and early versions of the product with possible customers, and checking how often people click on blog posts. The best tool we have used so far was to put a price tag on a potential solution. This helped us quickly see how important a problem really was and how well a solution would work for the people we wanted to sell it to. Another positive side effect was that we were able to generate revenue relatively quickly because we offered solutions as a concierge MVP, which gave us the opportunity to grow more organically. Another advantage is that this has given us very good insights into our customers’ processes and, while manually processing customer orders, we have already gained a better understanding of what a possible software solution might look like. Even now that our software is actively used in the market, we continue to use this approach to open up interesting new segments for us.

But this approach also has some disadvantages. It might remind you of a consulting or agency business. This is where the temptation to become a consulting or agency business and stop innovating might arise. But if the founders think that they can solve the problems of the target group better this way, then that’s OK and a great achievement. But if the company’s vision is all about being disruptive, it’ll be hard to keep investors and customers on board in the long run. After all, investors and customers may have put money into the company because they thought it would create a new product that would make a lot of money and solve problems for customers. Also, some of the people on the vision team who were excited about the new product might decide to leave and look for other opportunities to use their skills. So, the founding team should discuss in advance how far this strategy will be pursued and when the product that is actually to be brought to market will be built in parallel.

In summary, the journey of early-stage product discovery is a dynamic interplay between understanding market needs, identifying the right problem, deeply engaging with your target audience, and validating your solution through tangible metrics. With these insights, founders can lay a solid foundation for a successful product launch and sustainable growth.

Leave a Reply